boulder co sales tax efile

The Boulder County sales tax rate is. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides.

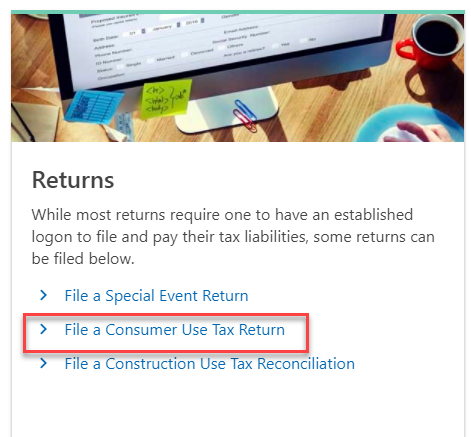

Consumer Use Tax How To File Online Department Of Revenue Taxation

The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes.

. View sales tax rates applicable to your specific business location s. Sales tax returns may be filed quarterly. Navigating the Boulder Online Tax System.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. 400 Duplicate registration. Annual returns are due January 20.

Colorado Department of Revenue. The tax relief measures will mirror IRS measures in the. Through Revenue Online you can also.

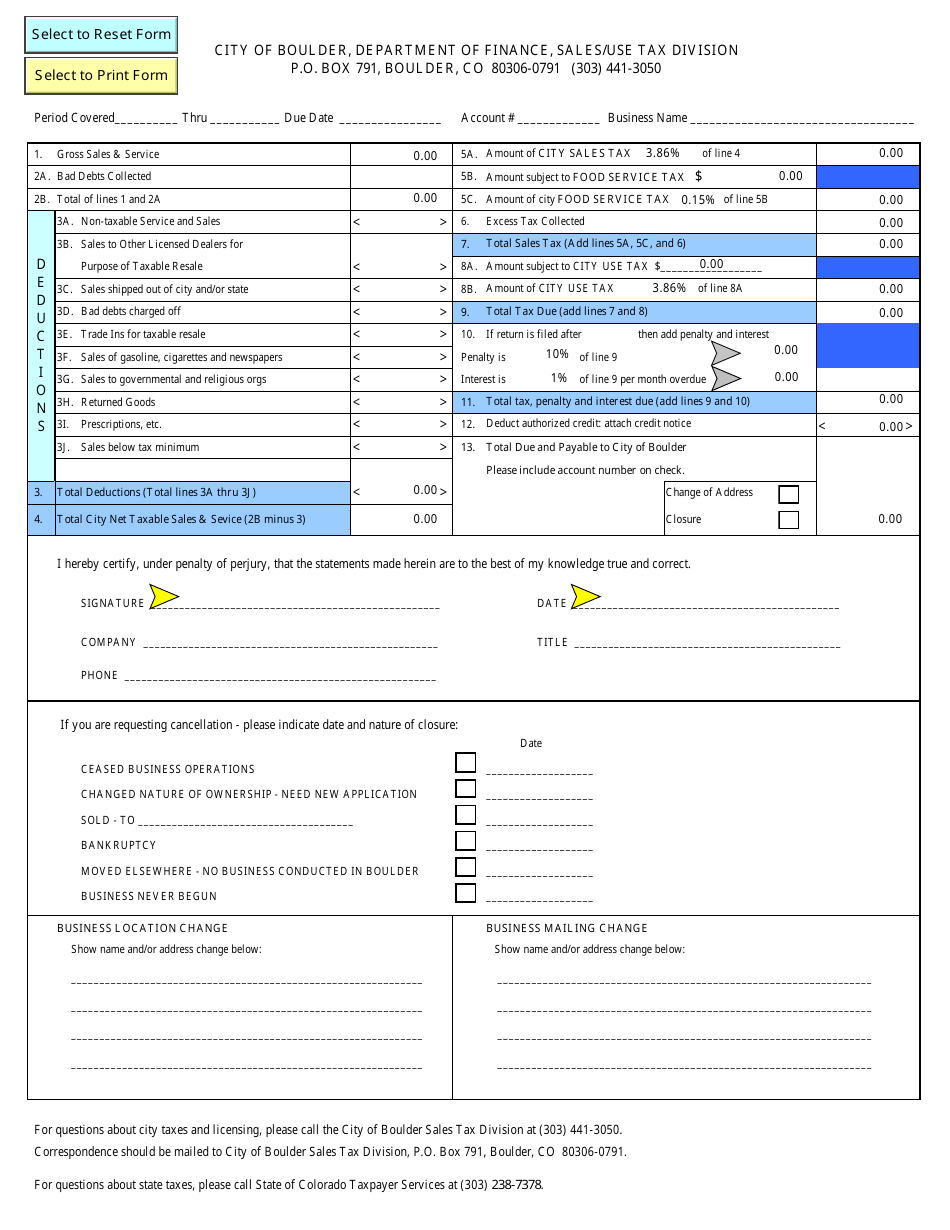

The minimum combined 2022 sales tax rate for Boulder Colorado is. Filing of the return is required for all. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort. 820 Duplicate title. The County sales tax rate is.

This is the total of state county and city sales tax rates. If you need additional assistance please call 303-441-3050 or e-mail us at. The City may charge sales tax on items on which the State of Colorado does not.

For additional e-file options for businesses. Businesses with a sales tax liability between 15-300 per month Return and payment due on or before the 20th of the month following the end of each quarter Monthly Filing. Kailee Nicole Foerster 2338 14th Street Unit 2 Boulder CO 80304 949-409-5911.

Businesses located in the Center Fee districts sales tax rate is 175 and is in addition to the district fees. The minimum combined 2022 sales tax rate for Boulder County Colorado is. 2055 lower than the maximum sales tax in CO.

The 2018 United States Supreme Court decision in South Dakota v. - January 5 2022 - The Colorado Department of Revenue CDOR understands some taxpayers will be unable to meet Colorado filing and payment deadlines as a result of the recent Marshall Fire. 350 Homemade trailer ID.

There are a few ways to e-file sales tax returns. If you have more than one business location you must file a separate return in Revenue Online for each location. Senior Tax Worker Program.

Of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

CDOR is offering relief on state-collected taxes to Colorado taxpayers who have been affected by the Marshall Fire. Return the completed form in person 8-5 M-F or by mail. PdfFiller allows users to edit sign fill and share all type of documents online.

15 or less per month. This is the total of state and county sales tax rates. About City of Boulders Sales and Use Tax.

The Colorado sales tax rate is currently. Boulder co sales tax efile Saturday May 7 2022 Edit. Accounting records must be retained by the collecting entity for three years from the date of filing and paying a return.

2020 13th Street Boulder CO 80302 Phone. You can print a 8845 sales tax table here. The Colorado state sales tax rate is currently.

PO Box 471 Boulder CO 80306. The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Online Sales Tax Filing.

If a lien is filed on the title filing fees for the security agreement document will depend on the size and number of pages. Businesses with a sales tax liability of up to 15month or 180year. 428 Year and Month Tab Replacement.

Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. Remote sellers have the option to file and remit for the City of Brighton through the Colorado Sales and Use Tax System SUTS. View amount of tax calculated by purchase amounts from 001 through 100 and search local sales tax rates by a specific address.

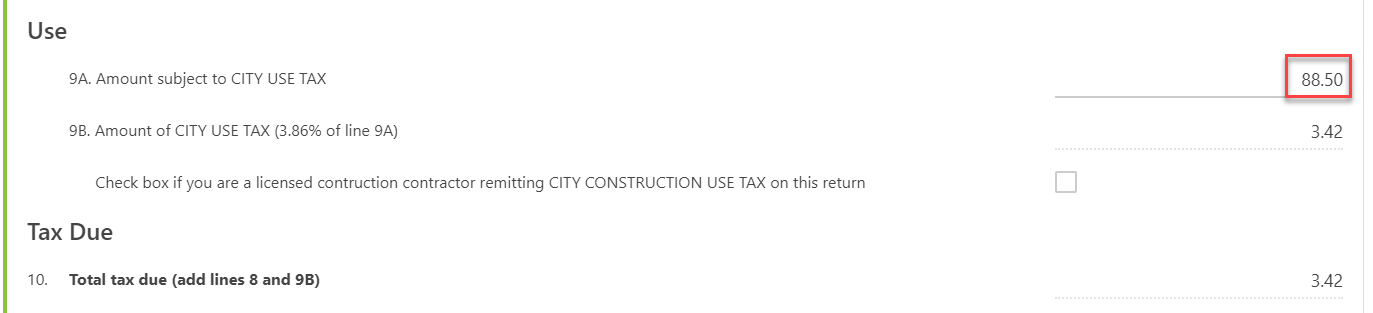

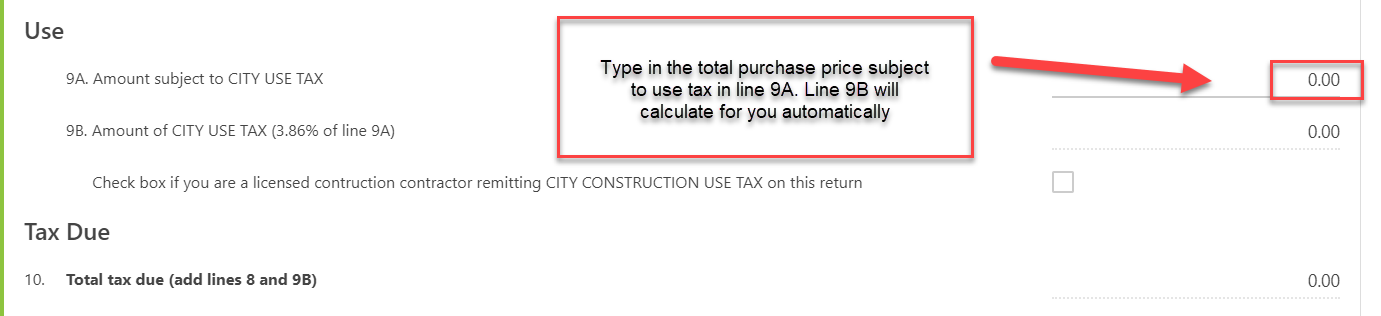

The example below shows that City sales tax was not collected and is therefore due as use tax. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers. Sales tax returns may be filed annually.

For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov. View sales tax rates by specific city or county. Para asistencia en español favor de mandarnos un email a.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The 2022 sales tax rates for taxing districts in Boulder County are as follows. Information about City of Boulder Sales and Use Tax.

The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. Did South Dakota v. Boulder 386 - 290 110 0985 8845.

Has impacted many state nexus laws and sales. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. The Boulder sales tax rate is.

Filing frequency is determined by the amount of sales tax collected monthly. Return and payment due on or before January 20th each year. There is a one-time processing fee of 25 which may be paid by cash or check.

Boulder Online Tax System. 720 Title print only. Wayfair Inc affect Colorado.

Under 300 per month. If only County RTD and State taxes 4985 were collected then the City use tax rate of 386 is due and payable to the City of Boulder. 417 Year Tab Replacement.

Online Sales Tax Filing. To manage your Colorado sales tax account file returns and pay state-collected sales taxes online. For instance the City taxes food for domestic consumption while the State does not.

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. For tax rates in other cities see Colorado sales taxes by city and county. Colorado Taxpayer Services.

Construction Use Tax is the salesuse tax paid by contractors or homeowners for construction materials used when erecting building remodeling or repairing real property. Sales tax rates are also available in the Colorado Sales.

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

File Sales Tax Online Department Of Revenue Taxation

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Co Dept Of Revenue Co Revenue Twitter

File Sales Tax Online Department Of Revenue Taxation

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Sales And Use Tax City Of Boulder

Tax Accountant For U S Expats International Taxpayers Us Tax Help

Tax Reform Faqs Top Questions About The New Tax Law Bdo